As a job manager or chief appraiser at a bank, appraisal workflow can be handled by Outlook/Excel, outsourced to AMCs or third-party workflow platforms. Sometimes when we’re talking with prospects about our workflow platform YouConnect we hear, “Yeah, we’re good” and “If it’s not broke, don’t fix it.” Understandably, you’re busy.

Very busy. There’s little time to calculate the true cost of the wrong platform. What’s at stake; a potential significant loss of staff time, money (under performing partner of the lending department) and eroding competitive effectiveness.

The Cost of Using the Wrong Platform

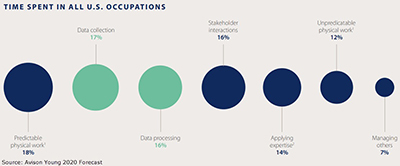

Based on the Avison Young 2020 Forecast chart, I would extrapolate (albeit across all occupations) that daily tasks for job managers would include data collection, data processing and applying expertise or 47% of their day. Assuming a job manager makes $70,000 per year, this equates to $32,900 in labor. Assume a chief appraisers makes $125,000 per year with their tasks to include data collection, stakeholder interactions, applying expertise and managing others that total 54% or $67,500 of effort.

For the above two employee’s example, the total annual labor investment associated with ordering appraisals is $100,000 rounded. Our math includes staff appraisers, reviewers and support. This “back of the napkin” discussion highlights the impact of an effective appraisal workflow platform to create a cohesive, finely-tuned appraisal department.

If one digs deeper, custom reporting, ongoing new feature development and comp data are the critical differential. If your workflow provider takes months (if not years) to roadmap new features, it’s often too late. Internal processes may have changed, bank acquisitions brought in new players or a different management culture.

The Impact of an Effective Appraisal Workflow Platform

Avison Young’s US report states that in 2020; “U.S. consumers and businesses will continue to operate with cautious optimism, with global uncertainty persisting…” Maybe it’s a great time to re-evaluate if you’re really “good” with your solution. One surprising result might be a substantive improvement of the lending and credit department relationship.

Since much of your efforts are spent around the appraisal workflow process, shouldn’t the solution be a premium brand, best in class? The ability to collaborate with a “small giant” technology company that aligns your bank’s processes is essential.

Especially in light of the report’s findings; “If the industry is going to optimize its use of automation and artificial intelligences, it needs to start assessing its data needs and acting on them. For real estate in particular, the scope and pace of these advances should cause us to focus on the processes embedded in our industry.”